Cambridge Forum For Estates & Trusts Practitioners Recap

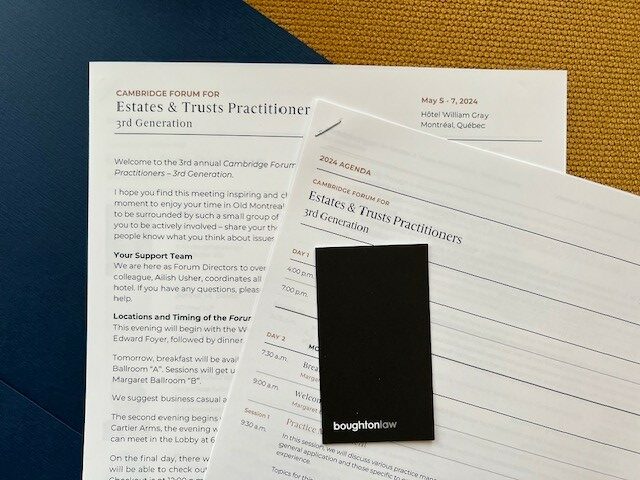

Early May marked the 2024 Cambridge Forums ‘Estates & Trusts’ meeting in Montreal. This annual event brings together leading tax, estate and trust professionals selected from across Canada for a three-day collaborative forum.

Boughton’s Catherine H. Kim attended and provides a recap from the Hôtel William Gray in Montreal.

Educational Benefits of a “Cohort” Model

Catherine attended the “3rd Generation Forum”, which is for practitioners with 7 to 14 years of experience in estates & trusts. Practitioners with more years of experience would attend either the 1st or 2nd Generation forums.

A key aspect of Cambridge Forums is their “cohort” model, which means the attendees are at similar stages of their careers and will progress through continuing education like this forum together as a cohort each year.

“Being at similar stages in our professional lives (and in many cases, our personal and family lives too) created an immediate common bond among the attendees,” explains Kim. “The seminar-style discussions felt very organic because of that bond – and the resulting honesty and openness, especially on topics like practice management, led to some great discussions. Many educational seminars are structured to appeal to a wide range of experience levels but the cohort model allowed us as a group to focus on questions and issues most relevant in our practices.”

Probate & Estate Litigation Considerations – Variations from Coast to Coast

With the aging population, there has been a surge in probate applications across Canada. It is also increasingly common for a deceased’s estate to include assets in more than one province (or country).

With the aging population, there has been a surge in probate applications across Canada. It is also increasingly common for a deceased’s estate to include assets in more than one province (or country).

“The process for obtaining a probate grant varies from province to province and key differences include how much is assessed in probate fees. B.C. and Ontario assess probate fees based on the value of estate assets. In contrast, Alberta has modest cap on probate fees and Manitoba has eliminated probate fees entirely,” says Kim.

Kim explains that, “Accordingly, practitioners from across Canada have differing takes on how much, if at all, to strategize with estate planning clients on minimizing probate fees or avoiding the probate process altogether. Discussions also included how each province deals with ‘wills variation’ or ‘dependants relief’ applications, with B.C.’s Wills, Estates and Succession Act being the most permissive in the types of challenges that can be made in relation to Wills. This in turn impacts how common (or uncommon) it is in each jurisdiction for tools like ‘joint asset’ planning or ‘alter ego/joint partner trusts’ to be used.”

Ongoing Uncertainty

The last 24-months have already seen a high-level of volatility impacting estate planning. From the Federal government’s flipping tax and similar provincial provisions, to trust reporting requirement and proposed changes to capital gains calculations, any estate planning must take into account a certain level of uncertainty.

“We discussed as a group various ‘best practices’ for how to provide our clients with comprehensive advice,” says Kim. “But the checklists of questions to ask, issues to identify and pitfalls to warn clients about is becoming a bit much. That saying ‘it’s what you don’t know that hurts you’ sums it up nicely and I am grateful to be part of a community of estates and trusts practitioners who are keen on supporting each other in this ever evolving legal and tax landscape.”

Looking for Wills & Estate Planning support? Contact Boughton’s Catherine H. Kim to begin the discussion.